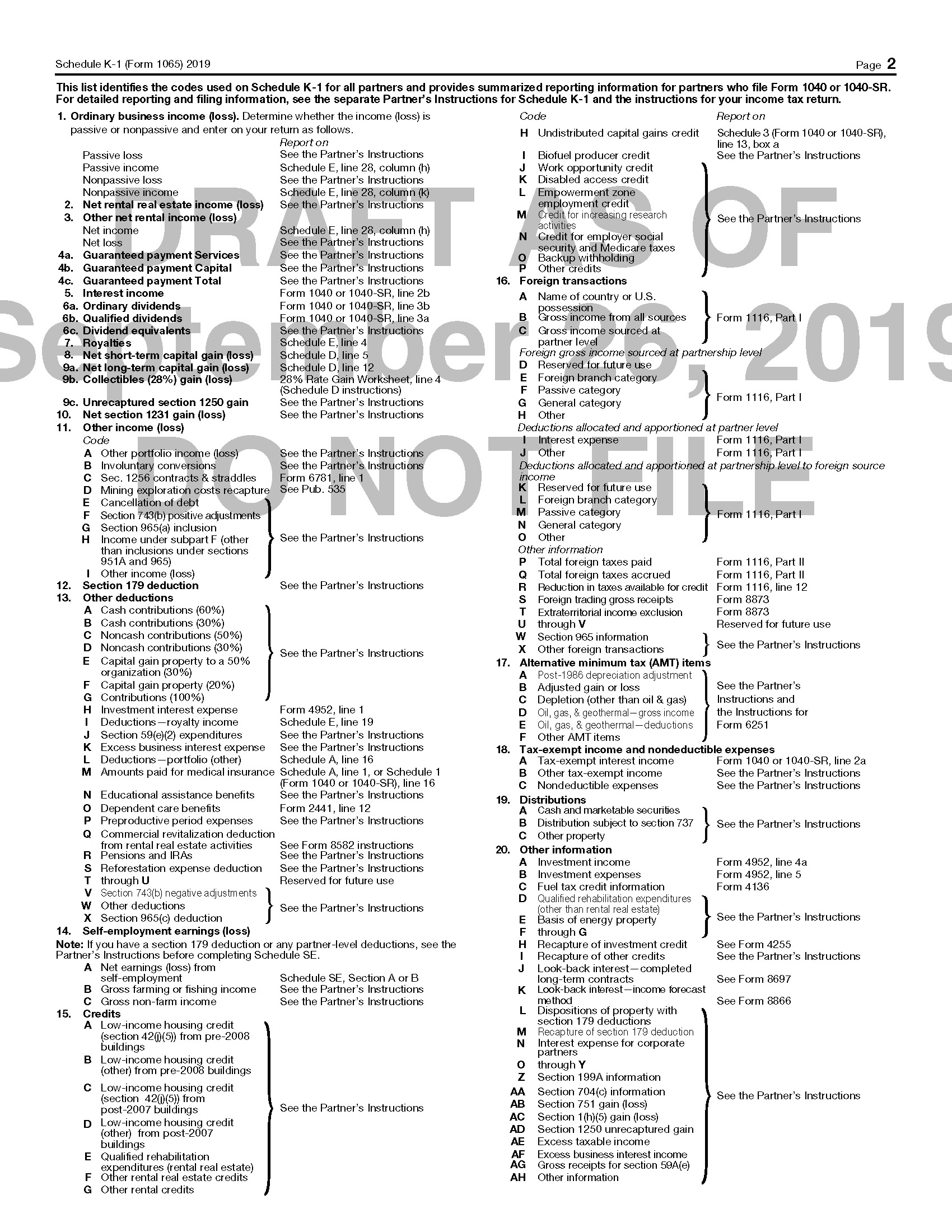

For instance, if you’re running a multi-member limited liability company (LLC) and you did not register to be taxed as a corporation, you will file taxes like a partnership using the Form 1065.ĭownload Guide Why Partnership Agreements Matter to 1065 Filings having a verbal agreement to conduct business as a partnership), you will file the Form 1065 even if you’re not registered as a partnership. Instead, all tax payments take place when partners file their personal income tax returns. In other words, while all partnerships need to file a Form 1065 each year, there is no required tax payment associated with it. This means profits and losses go directly through each partner, and each partner will enter their share of profits and losses on their personal tax returns. It’s important to note that all partnerships act as “pass-through” entities. A partnership agreement could define your entity as a general partnership, limited partnership, limited liability partnership, LLC, etc. A partnership is a legal entity type formed by two or more individuals who sign a partnership agreement to run a business as co-owners. Who Needs to File Form 1065?Īll business partnerships must file Form 1065. On a Form 1065, partners will report their income, gains, losses, deductions, credits, and other information needed by the IRS. Return of Partnership Income, is the form used by business partnerships to file their yearly federal tax returns. Overall, if filling out the document is challenging, it is advised that you check out the guidelines from the IRS or consult with your bookkeeper to save time.The IRS Form 1065, U.S. Partner’s revenue share, as well as credits, losses, and deductions over the current financial period.īear in mind that you can leave certain parts in your Schedule K-1 Form 1065 blank.

#K1 1065 TAX FORM FULL#

Details about the partner: partner’s id number, full name, address, as well as the type of partnership and the type of entity.Details about the partnership: CEO’s id number, entity’s business name, full address, as well as your business’s IRS filing address, and whether your business is traded on a stock exchange or a publicly-traded company.When filling it out, make sure you provide the following data: Luckily, the Schedule K-1 Form 1065 is a single-page document. Partner within a Limited Liability Company that has chosen to pay their income taxes as a business entity.Operate in a limited liability partnership.You have to file the Schedule K-1 (Form 1065) if you’re: And that’s where the Schedule K-1 form comes into play.

Therefore, tax liability is shifted from the entity to the persons (partners) whose common operation is concentrated on it. The thing is, in the US, partnerships are treated as the so-called ‘pass-through’ entities. Schedule K-1 is submitted as part of your Partnership Tax Return, Form 1065, which documents your business entity’s total net revenue. What You Need Schedule K-1 (Form 1065) For This document should be prepared by each partner within a business entity. Schedule K-1 (Form 1065) is an IRS tax form issued annually for the purpose of documenting the revenue, profits, losses, and credits of each partner within a business entity, as well as other IRS-focused financial details about business partnerships.

0 kommentar(er)

0 kommentar(er)